After years of experience of trading in several financial markets what I learned is that any trading systems besides trend following systems will fail in the long run. This happens because the market is very dynamic and unpredictable in nature.

The fundamental truth of the market is- No one can predict exactly what will happen and when it will happen. In other words, anything can happen. Sorry to say that but that’s the cold hard reality of speculation.

The market might not continue rising just because it has bounced from a significant support level or market might not continue falling just because it has pulled back from the major resistance level.

Anything can happen in the market. It is impossible to execute a long position at the exact bottom of the swing and to execute a short position at the exact top because no one can predict those reversal levels. However, there is good news! , trends do exist in the market.

Markets Trend!

One of the basic principles of technical analysis is- Markets trend! Among other principles of technical analysis this is the most important one because, as a trader, the trend is everything. If one buys currency/stock/commodity its price has to go up to make money; there is no other way.

Similarly if one short currency/stock/commodity, one makes money only when the market price falls. Yes, market price rises and falls that is the beauty of the market.

When the market moves in a particular direction (up or down) for a certain period, the trend is established.

The market does not Random Walk and to verify this theory you just have to open your charts and see it. Let’s have a look at the NZDUSD H1 chart.

In the above chart, you can see that the market is moving in a certain direction (down) over a period of time regardless of the fact that it has moved in both directions.

This is an example of a down-trending market. In a down-trending market, the market bounces little and declines largely.

Trend is Your Friend- The most important truth ever told on market

Trend following system is all about trading in the direction of the major trend. When a trade is executed in the direction of the major trend, statistically, the trade is likely to be a winner than loser because the trend does not change overnight. But you should be aware of the length of the trend that you are following.

Suppose, if you are looking at an intraday chart and it shows that the market is down trending, but in reality, it might be just a correction of a midterm up-trending market.

In such instances, if you hold your short position too long thinking that the trend will continue to downwards, you might end up losing a substantial amount of your money.

These are the problems traders face when they don’t have a proper trading system with them. It is still okay to follow the trend of the intraday time frame as long as the trend continues, but you should not hesitate for a second to exit as soon as the trend reverses. A good trading system should have predefined entry and exit points.

Newbies Can Profit From Trend Following Forex Trading Systems

Newbies can benefit a lot from trading systems because a new trader is always confused about what tools to use, how to use, and when to use.

A new trader who does not know where to start from should start trading with a trend following system on Metatrader 4 (MT4). It wouldn’t be surprising to see that new trader making money on a consistent basis provided that he/she has followed the rules of the system strictly.

Trading is simple, but people make it complicated believing that complicated analysis will be profitable. Learn to be the follower of the market, not the predictor, and soon you will see your trading account growing exponentially.

Many traders with years of experience still fail miserably in the market. It happens because they are too busy studying new ways to analyze the market and learning new techniques every day hoping that they can find a method that can predict the market precisely all the time.

After spending some good years researching on trading strategies and not being profitable, one understands that trend following strategies is the best strategy and feels that one should have kept it simple from the beginning.

Must Read: Best Forex Brokers in South Africa

Trend Following Systems Are Simple

One might say- “okay! I want to trade with trend following strategies but how do I start?” The good part is that you don’t have to learn so many things to start trading with a forex trading system.

You just need to understand what those indicators in the system indicate and what actions to take accordingly. You should understand under what circumstances BUY and SELL signals are generated by your system.

Your system should tell you when to stop your losses and when to book your profits. No worries! We have explained all of the trading systems in details on trendfollowingsystem.com

Know What is a Trend

Since we share the only trend following forex trading systems here, it might be beneficial to understand the in-depth concept of the TREND.

The market can move whether up, down, or sideways. When the market moves continuously upward making higher highs and higher lows, it is an uptrend market.

Similarly, when the market moves continuously down making lower highs and lower lows, it is a downtrend. When the market is unable to make significant highs and significant lows over a certain period, the sideways market is formed.

Trends are formed due to the imbalances of supply and demand. In an up-trending market demand is higher than the supply and in the down-trending market selling pressure dominates the demand. When we talk about trends, we can’t ignore the length (time) factor. There are mainly four lengths of trends.

i). Primary Trend

The primary trend is the major trend in the market. Being able to determine the primary trend correctly is the key to profits. However, there are no tools to forecast the duration of the primary trend. The primary trend is the longest trend of all.

The primary trend lasts for several years. The primary uptrend market is often called the “Bull market, ” and the primary downtrend market is referred to as a “Bear market”.

The market characteristics are the same in the primary uptrend market and primary downtrend market, so, here, we will be explaining things in terms of the uptrend market.

Above is the USDJPY primary uptrend market which started in 2012 and ended in 2015. The market consolidated and corrected several times in between, but ultimately it went up in its primary trend’s direction.

Unlike in the stock market, in the forex market, retail traders don’t hold their positions for years, but one can hold up to several months. While trading in such ways, one should be informed about the prevailing primary trend of the market.

The short positions in the above USDJPY market during that time would automatically be riskier as the market was moving upward in general.

The primary bull markets consist of three phases: accumulation, public participation, and distribution.

This picture explains best about the psychology of the traders in various phases of the market. The accumulation phase is the beginning of the primary trend. A primary uptrend market starts after the end of the primary bear market.

The smart and informed investors enter the accumulation phase while the public is still unaware of the opportunity. During such market conditions investors do not like to talk about the markets, they do not like to watch the markets because they are so frustrated by the loss they had in the recent downtrend.

When the market rises for several months/years, the general public notices this rise, and they start to buy. People keep on buying because they see profits and many new traders enter in this phase and the market rises even higher due to the rising demand. It is the public participation phase.

In the distribution phase market is at the peak, people are super optimistic and greedy. Traders place long positions even without analyzing the market. Everyone talks about the market everywhere. During such times smart traders/investors begin to short the market seeing the dangers of a downtrend while the herds (crowd) are still buying blindly.

ii). Secondary Trend

The secondary trend is the movement against the primary trend. In a bull market, the downward movements which last for several months to a year is a secondary market.

The most difficult thing to understand for any trader in the world is- to know if the market is just in a secondary corrective phase or the trend is changing.

iii). Minor Trend

Minor trends last for several days to weeks. The swing traders in the forex market especially look at minor trend and secondary trends.

iv). Intraday trend

The intraday trend is the market trend that lasts for a few minutes to hours. In an intraday trend, we look for the trend which occurs during a single trading day. Day traders/scalpers use the intraday trend to make short term trading.

The Choice is Yours!

So, it is your job to choose the timeframe you trade on. But analyzing the market in a time frame necessarily doesn’t mean that you should ignore other time frames.

When you are trading in a particular timeframe, you should also look for the next higher time frame and the next lower time frames.

For example, if you are trading on an hourly chart, you should also be looking at a 4-hour chart and the 30-minute chart or the 15-minute chart because long term trends will be impacting the short-term trend and the short term timeframes signal the reversals earlier.

The best part is you don’t have to analyze the market yourself; your trading system will do that for you. Just follow the rules of the trading systems strictly and be disciplined enough not to violate them.

The best thing about using a trading system is that even a newbie trader can use a trading system and still be profitable.

Downloading and Installing Trading Systems on Your Metatrader 4

The entire trend following systems here is compatible with MT4. You should install those trading systems in your MT4 before you can use them. Below is the step by step procedures to install the trading system.

1. Download The System/Indicator

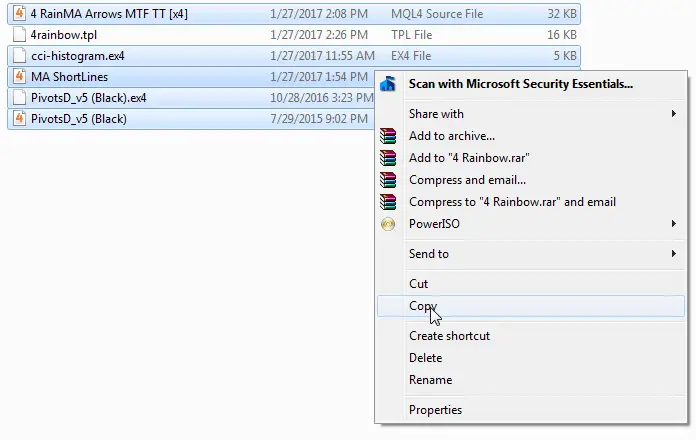

After you download the systems (or indicator) extract the zip files.

2. Copy the MQL4 files and EX4 Files to the Data Folder

Once you extract the folder, you see TPL, EX4, and MQL4 files. You don’t need to copy the template files (.TPL), just copy the EX4 and MQL4 files into the data folder.

To open the data folder go to your MetaTrader 4. Under the File menu click “Open Data Folder”. After this, a window will be opened. Go inside the “MQL4” folder.

Open the “Indicators” folder. Paste the Ex4 and MQL4 files you have copied.

Open the navigator window in MT4 by pressing Ctrl+N. Under the indicators heading right click and refresh the indicators lists.

4. Load the Template

Now, load the TPL file which you downloaded from the trend following system. On your MT4 chart, right-click, select template, and select load template. Give the path to your TPL file and open it.

Once you perform all these steps, you are ready to trade with your trend following systems.

Get Started!

A trend-following system consists of several technical indicators. With combinations of several indicators, the trading system generates and confirms the trading signals.

Not all trading systems are good but almost every trend following forex trading systems is great. We only share those trading systems which are tested on at least 100 trades. Most of the time in the forex trading space, traders lose not because of the trading systems but because of their own emotions.

There are so many classical technical tools that still work well, but people still lose using them. It’s because they don’t follow the rules of those tools consistently.

To an undisciplined trader, even the best trading system in the world won’t work. On the other hand, a disciplined trader can make money using very simple tools like moving average.

However, the bad trading system won’t help a disciplined trader. You can get the best trading systems here, and it’s your job to make money trading them. Happy Trading!