Chartered Market Technician (CMT) is a professional technical analyst certified by CMT Association, NYC, US. CMT is the most recognized technical analysis designation worldwide. Being a CMT charter holder is a significant milestone for any technical analyst who aspires to become a professional technical analyst working for big firms.

It is impossible for someone (firms and your clients) to know how much you know about the market and technical analysis just by looking at your profile and resume.

Certification programs as such, which is considered to be a gold standard certification in the technical analysis space, adds credibility and trust in what you do.

What I learned in the CMT Program?

As I passed all three levels of the CMT program, I have some understanding of what value it adds to your career and understanding of the market.

Although I had been working as a professional technical analyst for more than 4 years (8 years including personal experience), I experienced a paradigm shift when I enrolled in the CMT program and started going through its curriculum.

After reading the CMT curriculum I realized that I was only focused on the small part of the technical analysis, I was missing the bigger picture. It broadened my horizon in the technical analysis philosophy.

Another major shift that occurred as I enrolled in the CMT program is that I started to spend more time on Excel spreadsheets and python programming rather than actually looking at the charts.

Because the importance of objectivity or a systematic approach was the major thing I learned during the program.

I knew earlier that the systematic approach was important to excel in trading but I understood how to actually do it only after enrolling in the program. CMT program helped me a lot to do better in my professional as well as personal trading career.

Another great thing about enrolling in the CMT program is the community is great there. There are many local chapters around the globe where interested people can join and learn from the experts.

CMT Annual Symposium, which takes place in New York City, is one of the world’s biggest technical analysis events where veteran technicians meet and share their knowledge. Very popular technicians, professionals, and traders can be met at this event.

Check Out: Top 10 Free MT4 Forex Indicators

What is the Best way to Pass The CMT Exam?

As suggested by CMT Association, the best way to prepare for the CMT exam is by reading the curriculums recommended by the CMT Association.

Rather than reading many books from which the exam content is based, reading the updated books recommended by the association is the best and most efficient way to pass the exam.

That is what I actually did and I couldn’t agree more. It is almost certain that whatever you see on the exam is going to be from the officially recommended books.

Trend Following System is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com.

What’s in the CMT Program?

CMT program has three level exams which can be attended in a gap of 6 months. Meaning that if you pass the exams continuously in the period of 6 months, you can pass all levels of CMT exam in one and half years.

Now let’s go through what you will be tested on each levels of exams.

CMT Level I

In the CMT Level I exam you will study the basics of technical analysis and you will be familiar with the basic tools, terminologies, and techniques of technical analysis. The exam duration is two hours and it will contain 132 multiple-choice questions.

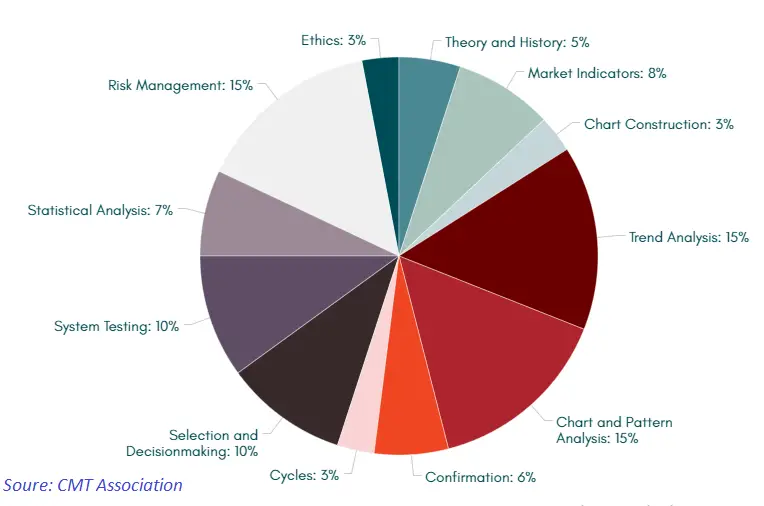

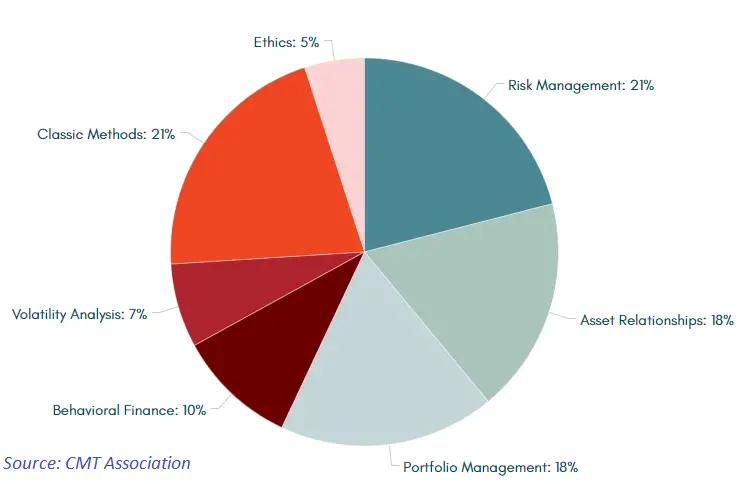

The level I exam comprises of topics like chart pattern and analysis, trend analysis, chart construction, market indicators, markets, theory and history, ethics, statistical analysis, system testing, selection and decision making, cycles, and confirmation.

If you are already practicing technical analysis at your personal and professional life, level I won’t be that hard for you. However for a beginner, with no background, it may be challenging but can pass if one invests good time, energy, and dedication.

CMT Level II

Personally, I felt CMT Level II quite tough as it covered a wide range of technical tools and indicators. While level I was about the introduction to the basics of technical analysis, level II is more about understanding concepts and implementation of those concepts, theories, and techniques. It is also tougher than level I because it is a 4-hour exam with 170 multiple-choice questions.

Basically, through all levels of exam you study the same topic but the depth and complexity of the topic rises as you go higher levels.

CMT Level III

In level III, you will have a different experience than the previous two because now you will have short-answer essay questions along with multiple-choice questions.

In the essay part, you will be given some charts to analyze and you have to write your opinions based on the knowledge you gained in the previous levels.

It is in level III that will test you if you really have understood the concepts and practical implementation that you learned in level I and Level II respectively.

For me, the last level was not as easy as I thought because I assumed that I was good at analysis so it wouldn’t be a big deal to pass it. Contrary to what I thought, I was unable to pass the third level on the first attempt.

My mistake was I analyzed the charts as per my previous understanding and knowledge rather than strictly implementing the curriculum-based knowledge which caused me to look at the market from my personal intuitive level rather than analyzing objectively as per the curriculum.

Once sensed this, I passed level III as well. So if you are very much passionate about technical analysis and markets, and see yourself as a full-time trader or trader for a big fund in the future, this course is for you.

Also Read: Top 10 Free MT4 Forex Systems

Why Should You Become a CMT?

You see, technical analysis is a different approach than fundamental investing. It has a unique approach.

The number of technical analysts is fewer than fundamental analysts so from a competitiveness point of view you have a better chance of landing a job at a lucrative trading firm.

In case you don’t want to do a day job, it will enhance your trading skills, and it will add credibility to your profile if you want to work with your clients. It is a designation that you will be proud to have.