In this article, we’ve tried to cover about deposit and withdraw funds in Exness accounts. This guideline will help you to understand the process of financial transactions with Exness and will assist in choosing the best payment method for you.

Exness doesn’t believe in laying barriers between its clients and their funds. The broker has been continuously upgrading its payment system to ensure the maximum comfort for the traders while doing transactions with Exness.

As a client, you’ll enjoy various payment options from e-wallets to bank wire transfers for funding or making withdrawals from your Exness account.

How to Deposit Funds in Exness Account?

- Log in to your Exness Personal Area

- Select the Deposit option

- Choose the payment method you wish to apply

- Select the currency and amount of your deposit

- Re-check your payment details and click on Confirm Payment

- You’ll be redirected to your payment system website

- Enter your payment system ID and password

- Enter the security code (if applied) and confirm the payment

Before you make a deposit please make sure that your account is fully verified which means your account has been reviewed and accepted by Exness.

If you are making the first deposit to your account then please check the minimum deposit requirements of your account type and select the amount equal or above the required funds.

How to Withdraw Funds from Exness Account?

- Log in to your Exness Personal Area

- Select the Withdrawal option

- Select the payment method you wish to apply

- Choose the currency of your withdrawal

- Enter the account number of your payment system

- Set the amount you wish to withdraw and click Next

- Check the details of your withdrawal and enter the security code sent to your registered email or phone

- Click Confirm Withdrawal and you’re done with your Exness Withdrawal

We recommend you to double-check the recipient account number of your payment system and other details before you confirm the withdrawal for avoiding any future inconvenience.

Also Read: Exness Review

The Process of Exness Internal Transfers

Internal Transfer means the disbursement of your deposited funds to your trading accounts. This distribution process helps you equalize the level of funds in your multiple trading accounts.

The following steps guide you through the Internal Transfers in between your Exness accounts:

- Open your account list from your Personal Area

- Select the accounts you want to transfer from and to

- Select the amount you want to move and click Transfer

- A summary will be shown with the details about the transaction and at the same time you’ll receive a security code through SMS or e-mail

- Enter the security code and click on Confirm Transfer

Exness also allows internal transfer among its clients. It is an alternative way to deposit and withdraw from your account. Besides, it doesn’t include any transfer fee and available 24/7.

The process of internal transfer between your trading accounts and to other clients is the same. Just enter the account number of the recipient Exness client and follow the steps mentioned above.

Internal transfers include some important restrictions:

- A client can transfer up to $500 per month to another Exness client residing within the same country.

- The payment system used to withdraw the transferred funds must be the same as the system used to deposit funds into your account.

- The amount you choose to be transferred to your new trading account must be equal or above the minimum initial deposit requirements depending on the account type.

- You cannot reverse an internal transfer after it is done and you’ll be responsible for entering the incorrect or wrong account number of the recipient. Exness is not liable to compensate for any input errors made by the clients while doing the transfers.

If you’re making transfers to another client’s account for the first time, you’ll be immediately notified mentioning “You have not previously transferred funds to this account” as a part of the Exness account security system.

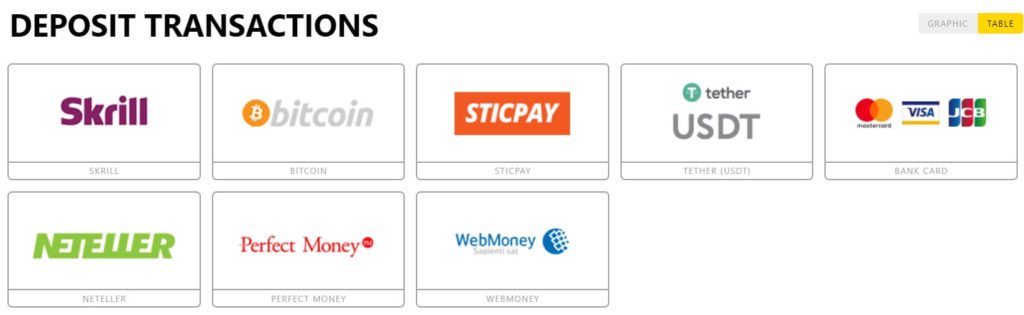

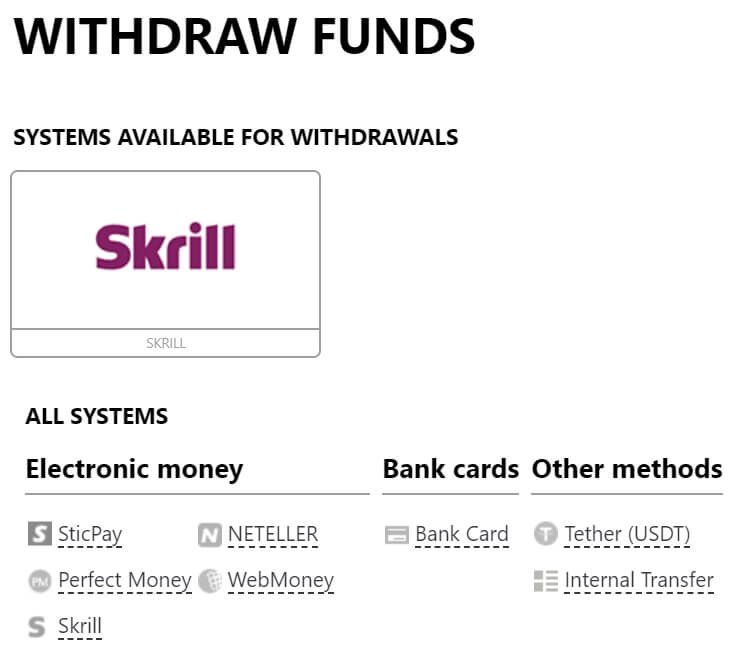

The Payment Systems Supported by Exness

Exness accepts almost all the top e-wallet payment getaways including other common payment systems like MasterCards, bank debit & credit cards. Here is the list:

- Bitcoin

- Tether (USDT)

- Neteller

- Skrill

- Perfect Money

- WebMoney

- Bank Debit & Credit Cards: Both Visa & MasterCards

Deposit and Withdraw Funds in Exness Limitation

The deposit and withdrawal limit vastly depends on the payment system you use for your Exness transaction.

- Deposit Limits: For Tether (USDT), WebMoney, and internal transfer, the minimum deposit limit is as low as $1. For Neteller and Skrill, the minimum deposit limit is $10. You can make a maximum $10,000 deposit to your Exness account in a single transaction if you’re using a Bank Wire transfer.

- Withdrawal Limits: The minimum withdrawal limit of your Exness account is $6. However, you can withdraw a maximum of $10,000 per transaction from your Exness account.

Exness Deposit and Withdrawal Costs

The deposit and withdrawals are completely free in Exness. As a part of providing the maximum flexibility to the clients over fund transactions, the broker has decided to lift all the fees incurred to deposit and withdraws to Exness accounts.

However, Electronic Payment Systems (EPS) apply their own transaction fees. Therefore, it is wise to check with your payment systems over the transaction fees for minimizing the fund transfer expenses.

Exness Deposit and Withdrawal Processing Time

The time span for processing your payment to Exness differs depending on different payment systems. Exness offers instant transfer for Neteller, Perfect Money, WebMoney, Skrill, and Instant Transfer.

Bitcoin transactions are processed within 4 hours. For Tether (USDT), the processing time is up to 72 hours. If you’re using bank debit or credit cards like Visa & MasterCards for deposit and withdrawals from your Exness account, it may take 3 to 5 days to process your payment.

Check Out: Open Exness MT4 & MT5 Accounts

Bottom Line

If you’re familiar with general electronic payment systems then transacting with Exness should not be a big deal for you. This is because the broker has made the fund transfer process simpler than ever.

If you compare the reviews of deposit and withdrawal process of Exness with other brokers, you’ll find Exness always stands one step ahead in terms of the simplicity in financial transactions.