Read in-depth Exness Review, I will share about the forex broker that I have been using for a long time.

Trading with a broker who takes care of the trading atmosphere, fund security, and transparency over the fees charged is a big relief for any trader.

But the way a trader or investor determines an online broker has been changed from time to time.

In modern times, people are smart enough to think out of the box and demand extra features from a broker with the hope of maintaining an easy trading life.

So far, I’ve reviewed many online brokers in my life intending to address the right trading home for traders, especially for beginners.

However, reviewing Exness is a bit different for me because I’ve been trading with them for a long time.

So, this time I’m not only reviewing a broker but also sharing my personal experience as an Exness client.

In this in-depth exness review, you’ll find all the details regarding

- Exness Spreads

- Account Types Leverage,

- Deposit/Withdrawal Methods,

- Safety measures taken by the company for protecting clients’ funds.

Also, we’ve discussed some of its special features that distinguish the broker from its other competitors.

Introduction – Exness Review

Exness is an online broker offering numerous trading assets including forex currency pairs, precious metals, Energies, Stocks, Indices, and Crypto-assets for its global clients.

The broker was established by a group of similar-minded entrepreneurs back in 2008. Since its inception, the company has established its registered offices in several regions of the world including, Seychelles, the British Virgin Islands, and Curaçao.

During its long run of over 12 years as a financial broker, the company has gathered valuable experiences which reflects in its trading-friendly features and initiatives taken for helping its clients get full control over their trading activities.

The broker offers multiple account types, MT4/MT5 platforms, competitive spreads, and flexible leverages.

Besides, it accepts various payment methods including instant withdrawal options through e-payments. Moreover, its education program for beginners and excellent customer support are some of the features that are worth to be mentioned.

Exness Regulations

Exness is regulated by top regulatory bodies such as

- Financial Conduct Authority – FCA in the UK (license no. 730729)

- Cyprus Securities and Exchange Commission – CySEC in Cyprus (license no. 178/12).

Besides the broker is also authorized by other regulators like

- CONSOB (Italy)

- FI (Sweden)

- CNMV (Spain)

- AFM (Netherlands)

- BaFin (Germany), etc.

Exness Account Details

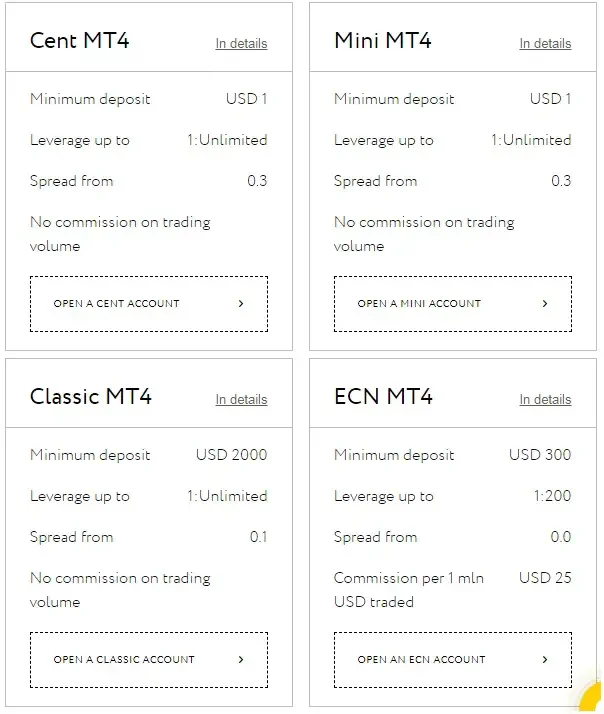

If you are using the MT4 platform you can open four types of accounts with Exness. Based on the type of account you are using spreads and minimum deposit may vary.

Leverage is unlimited in all types of accounts except with the ECN account in which the maximum leverage is 1:200. ECN accounts do not charge any spreads but it has a fixed commission rate of $25 USD per 1 million USD traded.

Exness Account Types

If you’re using the MT4 platform you can open up to 4 types of accounts in Exness. The spreads, minimum deposit limit, and leverages vary depending on the type of account you choose to open.

Beginners may start with Cent and Mini accounts. The minimum deposit requirements for these accounts are only USD 1. These accounts offer an opportunity to start with minimum capital.

So, you can see how your trading strategy works in live markets and experience the broker service by making a minimum investment. Besides, the unlimited leverage and tight spreads (from 0.3) will encourage newbies to cope with the global market competition.

The Exness classic account has been curated for professional intraday traders who wish to gain full access to financial assets for trading multiple instruments.

The spreads are very limited for classic accounts which start from 0.1 pips only. Moreover, there is no trading commission for these account users.

The broker focused on the needs of the expert day traders as well. So they brought the Exness ECN account. Its minimum spread starts from 0.0 which plays an important role in timely entry/exit for scalpers.

Considering the risk of short-term tradings the broker limited the leverage for ECN account up to 1:200. Also, they apply a fixed commission on trading volume for ECN clients which is $25 per 1 million USD traded.

Besides standard accounts, Exness also offers professional trading accounts such as Raw Spread, Zero, and Pro accounts for experienced traders.

How to open an Exness trading account?

It takes only 5 simple steps to open an account and start trading with Exness:

- Visit Exness Official website.

- Register for personal client area.

- Login to your Exness personal area and choose your favorite account type.

- Verify your identity and location.

- Deposit funds and start trading.

Exness Deposit and Withdrawals

Exness is highly praised for its flexible funding methods and a large number of payment options. Aside from regular bank transfers and credit cards, they also allow Neteller, Skrill, WebMoney, Perfect Money, Bitcoin, and USDT (Tether) as funding methods.

Interestingly, Exness offers instant withdrawal facilities for its clients. Both deposits and withdrawals through e-payment methods are processed instantly.

Funding through USDT and Bitcoin may take up to 72 hours to complete the transaction. Withdrawals through wire transfer and credit card may take 3-5 days. However, most of the deposits/withdrawals are processed within 24 hours and can be executed 24/7.

Please note that, if you’re using multiple payment systems for deposits then you’ll be allowed to withdraw funds proportionately to the same payment methods.

Also, make sure you’re only using your personal payment accounts for transacting with the broker for avoiding any complications over the transactions.

Detail Guide: Deposit and Withdraw Funds in Exness

Trading Instruments

The broker offers different types of financial assets that include a large number of trading instruments. As an Exness client, you’ll gain access to over 207 instruments including forex currency pairs, metals, natural resources, stocks, indices, and cryptocurrencies.

The accessibility to the financial assets and the spreads on individual trading instruments varies depending on your trading account types.

For instance, the Cent and Mini account users are entitled to selected forex and crypto instruments for trading. Whereas Classic and ECN account users get full access to all the trading assets provided by the company.

Customer Service

Customer service experiences have always been the best with Exness. They have multi-lingual customer support including English, Russian, Chinese, Hindi, Farsi, Urdu, Vietnamese, Indonesian, Arabic, Thai, Bengali, Malay, and Tamil. They have 24 hours live chat service and they respond very quickly.

Exness Trading Platforms

Exness offers 4 types of trading platforms:

- MetaTrader 4 (MT4): MT4 is the most popular trading platform among online traders. It represents comprehensive software that is fast, reliable, and user-friendly. Entry, exit, and modification of orders using Metatrader platforms are very easy and quite suitable for beginners aside from experienced professionals.

- MetaTrader 5 (MT5): It is an advanced version of MT4 platforms. MT5 is mostly used by algorithmic traders. This platform is quite compatible with modern automated trading systems or EAs. You can easily install your favorite trading robot on an MT5 platform and activate it instantly for starting automated tradings. This platform is also equipped with advanced chart analysis tools and 39 graphic objects for technical analysis.

- MT4 WebTerminal: The MT4 WebTerminal works as a global passport for traders. This platform only requires a web browser and internet connection to any device to access the financial market from anywhere around the world. Interestingly, you’ll find all the advanced chart analysis and trading features in a WebTerminal without downloading any software.

- Mobile Platforms: A mobile platform simply transforms your smartphone into a trading machine. Installing a mobile trading platform in your smartphone allows you to execute, monitor, and modify your orders from every place. Exness mobile platform is quite popular among Android users and currently, the software is rated 4.2 (out of 5) based on 18,578 votes.

Trading Tools

- Trader’s calculator: This calculator automatically calculates the margin, pip value, and swap fee of your trade entries. Simply input your account type, trading instrument, lot size, account currency, and you’ll find all the basic information you need for customizing your order.

- Currency converter: The currency converter is an easy currency conversion tool. It automatically selects the latest exchange rates and shows the conversion results instantly. It also converts fiat currencies to cryptocurrencies and vice versa.

- Free VPS hosting: VPS stands for Virtual Private Server. It lets you connect remotely to a server of another country from your PC. Exness VPS servers are located in the same data center as the broker’s trading server. So, when you use a VPS server, you enjoy an extremely fast execution of the orders. Besides, even if you’re having a bad internet connection, your order executions will not be hampered. You’re only required to deposit at least $500 to your trading account for being eligible for free VPS hosting from Exness.

Market Analysis

- Economic Calendar: The economic calendar helps you to keep track of upcoming news events about the currencies and financial announcements from the central banks of developed countries. The broker regularly updates its calendar and makes sure you’re not missing any upcoming major events which directly impact currency prices.

- WebTV: Exness is associated with Trading Central WebTV – an independent financial news agency that regularly publishes fundamental and technical updates about the top traded financial instruments. You can easily access WebTV from the official website of the broker. The updates are typically published before the beginning of European and London sessions. So, you can always remain updated regarding the whereabouts of major financial assets providing fundamental updates and technical analysis reports.

Education

Exness continuously uploads educational articles on its website. You’ll find the journals in the help center section on its website. These materials contain trading platform guides, trading tutorials, and technical analysis tips.

For beginners, we strongly recommend going through the educational journals provided by the company. Because these lessons are designed for the newbie traders who seek proper guidelines for getting started with their trading career.

Customer Service

The customer service experience in Exness has been always excellent. The broker engages well-trained agents for ensuring the best customer service for its clients.

The broker provides multi-lingual support including English, Russian, Chinese, Hindi, Farsi, Urdu, Vietnamese, Indonesian, Arabic, Thai, Bengali, Malay, and Tamil. The customer service department is active 24/7 and typically responds within 24 hours to any queries from the clients.

Sending an email is the best way to connect with the customer service team. However, for quick solutions, you may directly make phone calls to reach a customer care agent and get your solutions instantly.

Exness Pros

- Experience: Experienced over 12 years as an online broker in financial markets.

- Legitimacy: Regulated by FCA, CySEC, BaFin, and many other renowned regulatory bodies.

- Multiple trading accounts: 4 types of MT4 trading accounts including, Classic and ECN accounts.

- A large number of trading instruments: 207 trading instruments including 107 forex currency pairs, 81 stocks & indices, 12 metals & energies, and 7 cryptocurrencies.

- Competitive spreads: ECN account spreads start from 0.0 pips and for classic accounts, the spread starts from 0.1 pips.

- Unlimited leverage: Offers unlimited leverage and allows you to customize the leverage ratio according to your needs.

- Commission-free trading: The broker doesn’t apply any commission on trading volumes except for ECN account users.

- Multiple payment options: Bank wire transfer, credit cards, Bitcoin, and e-payments such as Neteller, Skrill, Perfect money, etc. are all available as funding options.

- Instant withdrawal: Withdrawals requested using e-payment methods are processed instantly.

- MT4 and MT5 platforms: Offers both MT4 and MT5 platforms that are compatible with Windows/Mac computers, tabs, and Android/iOS mobile devices.

- Advanced trading tools: Trading calculator, currency converter, and free VPS hosting.

- Market Analysis and Education support: Economic calendar, and WebTV for daily fundamental and technical market updates. Also provides tutorials/lessons about online trading and MT4/MT5 user guides.

- Multi-lingual customer support: 24/7 customer support in 13 languages. Well-known for quick and excellent customer service.

Any cons

- No Bonus: The broker is not offering any welcome bonus and deposit bonus for its clients.

Bottom Line

According to my thorough analysis and long-term personal experience as a client, I’ve found Exness as a full-fledged online broker who offers everything a trader needs for building a progressive trading career.

Apart from general features like tight spreads, flexible leverages, and a wide range of trading assets, the broker also entertains its clients with instant withdrawals, multi-lingual customer support, and advanced trading tools.

These features reflect the broker’s intention to provide a trading-friendly atmosphere for its clients.

Moreover, its daily technical updates, trading tutorials, and free VPS hosting prove that the broker cares about the client’s trading success and believes in growing together.

Also, its MT4, MT5, WebTerminal, and mobile trading platforms give more options of accessing the market from any device and anywhere in the world.

If you live in Europe or Asia, Exness is the best broker for you. As mentioned before I have many years of experience with Exness and I never faced any problem with this broker.

Hence I would recommend this broker. Please let me know what are your experiences with this broker and about this Exness Review.

Open your account right now with an Award-Winning Broker