Day Momentum Strategy MT4 is a trend following trading system that sharply follows the current market momentum to find potential trade opportunities. It is combined with some of the very best momentum based indicators to create a professional level trading strategy with strong trading signals.

Forex Day Momentum Strategy has been developed aiming to assist day traders and scalpers around the trading market. It is a good fit to 1-minute to 1-hourly charts and can be applied on any forex currency pair chart. Because of its simplicity of use, newbie traders can get a greater benefit who aims to trade based on momentums or market trends only.

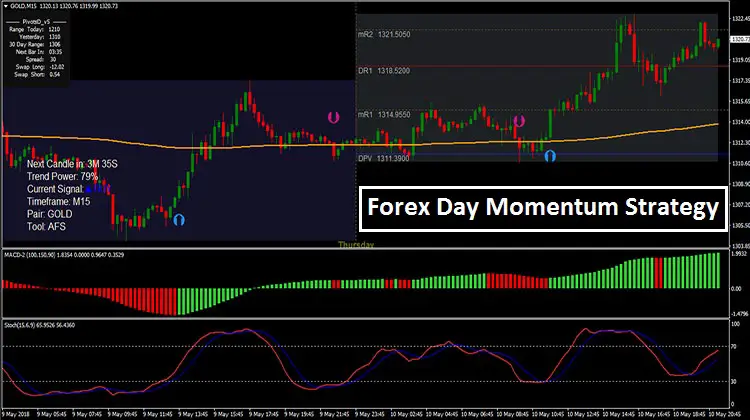

Forex Day Momentum Strategy Overview:

| Time Frame | Currency Pairs | Indicator Factors | Ratings |

| M1 to H1 | Any | 5 | 9.8/10 |

Forex Day Momentum Strategy Anatomy:

- AFS Arrows: This is a trade signal indicator. It plots buy or sell signals with its up/down arrows which is based on the market studies from other indicators of this system.

- PivotsD: It plots current pivot levels at the main chart window to assist decision makings with short-term support resistance levels.

- Moving Average: A 144-day period smoothed Moving Average has been used to identify the current trend of the market. Price above the line states bullish and below the level indicates bearish trend respectively. It is also used as dynamic support/resistance levels.

- MACD 2: This oscillator has been included to filter the momentum signal as correctly as possible. Its value above zero level signals bullish momentum and a negative value indicate bearish momentum is underway.

- Stochastic Oscillator: It is a well known momentum indicator among professional traders. It identifies possible momentum swing levels with its overbought/oversold signals. Its parameter at or above 70 is considered as overbought level and at or below the 30 level signals oversold condition of the market.

Check it out too: CCI with PRSI System

Forex Day Momentum Strategy: Buy Parameters

- AFS Arrows pointing upwards

- Price is staying above the Moving Average line

- Price is supported by the PivotD levels

- MACD value is positive

- Stochastic Oscillator is bouncing upwards from 30 level

- Stop Loss below the AFS Arrow

- Exit the trade when price is resisted from PivotsD levels and Stochastic Oscillator is at overbought level

Forex Day Momentum Strategy: Sell Parameters

- AFS Arrows pointing downwards

- Price is stayingbelow the Moving Average line

- Price is resisted to downwards from the PivotD levels

- MACD value is negative

- Stochastic Oscillator is bouncing downwards from 70 level

- Stop Loss above the AFS Arrow

- Exit the trade when price is supported by the PivotsD levels and Stochastic Oscillator signaling oversold condition of the market momentum.

Free Download Day Momentum Strategy MT4