SD Trend Following System is a forex trading system which is a purely trend following strategy. This forex trading system was developed by a developer who calls himself “Slumdog”. It is great to get such an amazing forex trading system for free. This trend following forex trading system is very simple to understand and it generates very clear signals. The signals are clear to the eyes and there is no any vagueness in the trading system which makes it very suitable for newbie traders as well. SD Trend Following System can be very profitable if the rules of the system are followed in a proper manner.

SD Trend Following System Overview

|

Time Frame |

Currency Pairs | Number of Indicators | Ratings |

| 5 Minute and Above | Any | 3 | 9.8/10 |

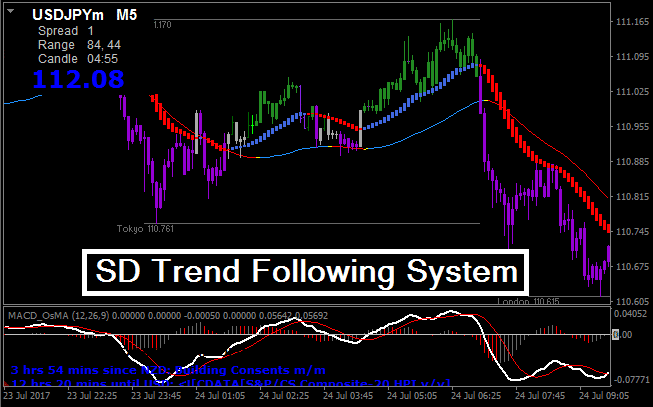

There are many indicators used in SD Trend Following System but we have focused only on three major indicators here because they are enough to trade profitably with this system. When you install SD Trend Following System your chart must look like this:

Let me show you three major indicators that are used in this forex trading system.

SD Trend Following Indicators Overview

| Main Chart | Indicator Window |

| HAMA | MACD OsMA |

| Special Bars |

Let me explain in brief about the major three indicators used in SD Trend Following System.

- HAMA

HAMA is the main signal generator indicator of SD trend following system. HAMA indicator works like moving average. In an up trending market it moves below the market price and it is blue. In a down trending market it moves above the market price and it is red.

- Special Bars

The price bars that you see on the main chart are a special kind of bars. They help out to smooth out the noise of the market. When these bars are green, you should know that the market is up trending and when these bars are purple, the market is down trending.

- MACD OsMA

MACD OsMA is a technical indicator which has histograms and two oscillators. Histograms fluctuate in positive and negative territory. When the histograms are positive, it indicates bullish market conditions and when the histograms are negative, it indicates bearish market conditions. White oscillator moves faster and the red oscillator moves slower. Their crossovers can be important to verify your trading signals.

SD Trend Following System: Buy Parameters

- The forex pair you are watching should be up trending.

- The market should be bouncing off the recent support level.

- The HAMA indicator should be blue.

- The histogram of MACD OsMA indicator should be positive.

- The white oscillator of MACD OsMA indicator should be above the red oscillator.

- Execute your buy position when all of the above conditions are met.

- Put your stop loss just below the recent swing low.

- Take your profit when the HAMA indicator turns red.

You Must Read: The Best Forex Trading Strategy Ever

SD Trend Following System: Sell Parameters

- The forex pair you are watching should be down trending.

- The market should be falling off the recent resistance level.

- The HAMA indicator should be red.

- The histogram of MACD OsMA indicator should be negative.

- The white oscillator of MACD OsMA indicator should be below the red oscillator.

- Execute your sell position when all of the above conditions are met.

- Put your stop loss just above the recent swing high.

- Take your profit when the HAMA indicator turns blue.

Hello

Please email me at email

How can I have a trading ligament?

Thanks