Double RSI Trading System has got the top rank among best Forex trading strategies in the financial market. This system comes up with an idea to combine the best Forex trend indicator RSI with dual parameters. A Fisher histogram oscillator has also been added with the system to make it more productive with steady level of success.

Double RSI Trading System is suitable to apply on all Forex currency pairs and can be adjusted with all sorts of timeframe charts available at the mt4 trading terminal. That is why traders from all levels can be benefited well from this amazing Forex trading system.

Double RSI Trading System Overview

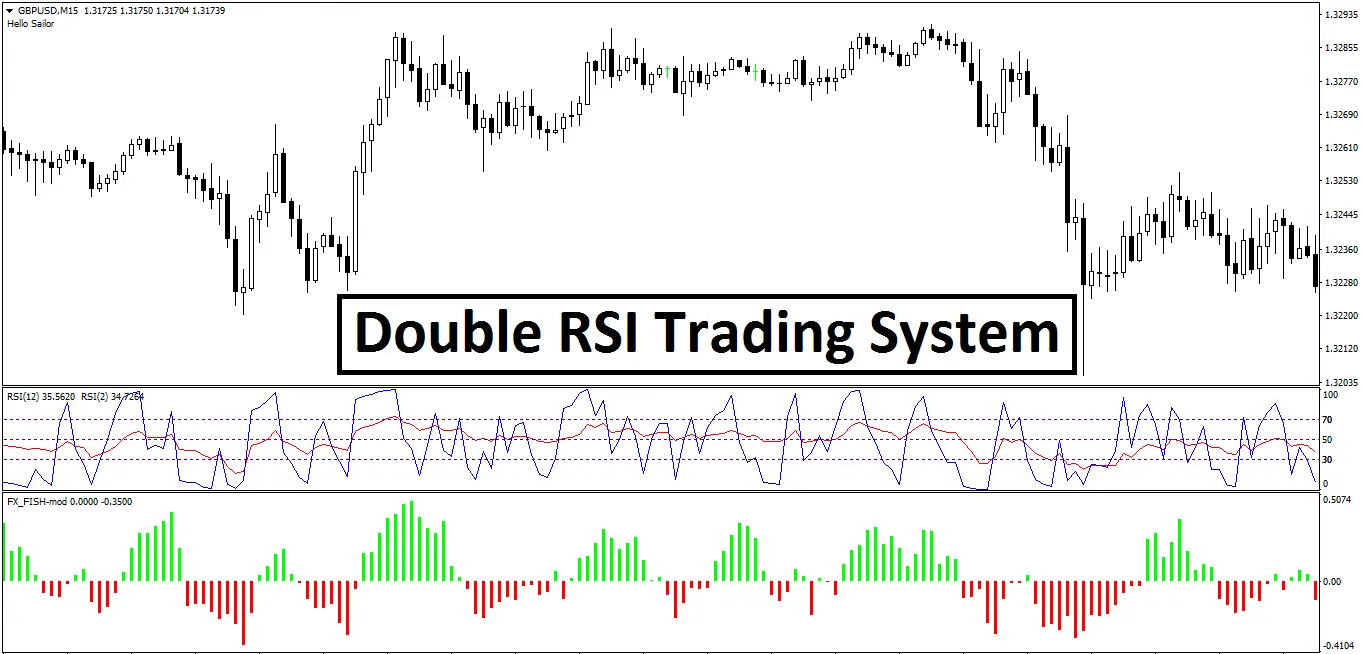

After the installation of Double RSI Trading System at your mt4 terminal, your trading chart should be appeared as the following image:

| Time Frame | Currency Pairs | Indicator Factors | Ratings |

| Any | Any | 3 | 9.7/10 |

Double RSI Trading System Anatomy

- RSI 2 & RSI 12: Here, an idea has been implemented to combine two different parameter of RSI at the same window. RSI 2 is fast and reacts with current price action very quickly. On the other hand, RSI 12 reacts more slowly to the price movements. RSI level at 70 is the overbought condition and at 30 level is considered as oversold condition of the market. RSI value positive signals the bullish force and a negative value is interpreted as the bearish thrust of the market momentum.

- FX Fisher: It is a momentum oscillator. Its value is positive and rising means the momentum is bullish and a negative value with a falling pattern signals the bearish momentum is still intact.

Recommended Strategy: Trend Power Strategy

Double RSI Trading System: Buy Parameters

- The respective signaling bar closes as a bullish candle

- RSI 2 crosses above RSI 12 from oversold condition

- FX Fisher value turns positive with a rising pattern

- Set stop loss below the signaling bar’s low

- Exit long whenever RSI 2 crosses below RSI 12 and FX Fisher turns negative at the same time

Double RSI Trading System: Sell Parameters

- The respective signaling bar closes as a bearish candle

- RSI 2 crosses below RSI 12 from overbought condition

- FX Fisher value turns negative with a falling pattern

- Set stop loss above the signaling bar’s high

- Exit short whenever RSI 2 crosses above RSI 12 and FX Fisher turns positive at the same time

How do I install the indicator on MT4