BMANS Renko Trading System MT4 is a completely trend following trading strategy that identifies both swing levels and trend continuations. Catching a market swing level correctly enables you to earn better reward compare to your risk.

\On the other hand if you can detect a trend continuation pattern, you’ll be able to join the trend with safer market entry. That is how Forex BMANS Renko Trading System is helping many day traders in their everyday trading life.

Forex BMANS Renko Trading System is suitable for all Forex currency pairs and fits best with intraday timeframe charts. All you need to do is learn and follow the rules to master this strategy well before you apply it for trade decision making purpose.

BMANS Renko Trading System Overview

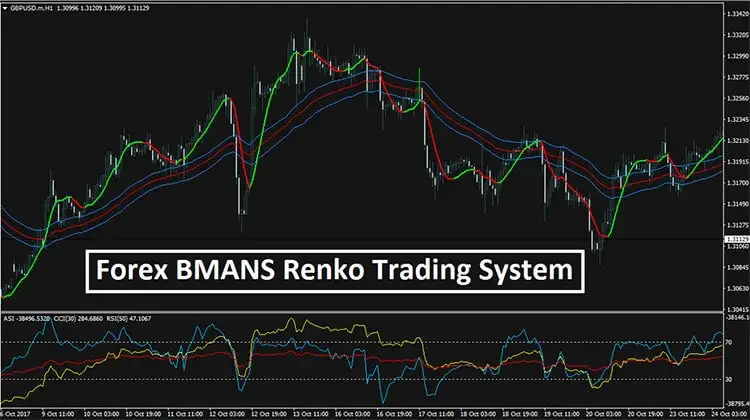

After the successful installation of this system in your mt4 trading terminal, your chart will appear as the image below:

| Time Frame | Currency Pairs | Technical Factors | Ratings |

| M15 to H4 | Any | 5 | 9.8/10 |

Forex BMANS Renko Trading System Anatomy

- Nonlang MA: This indicator identifies the current market trend. It turns green and price is above its level signals bullish trend, on the contrary, it is bearish trend when it turns red and price is below its level.

- Dragon Tunnel: This indicator uses a set of three price channels across the main chart window which defines the trend strength. Price above these channels are interpreted as bullish strength and if below then signals the bearish strength of the momentum.

- CCI: CCI around 70 levels indicates overbought and at 30 signals oversold condition of the market. CCI also plots bullish/bearish crossovers with RSI and ASI indicator.

- RSI: This indicator is a well known momentum strength identifier. As like as CCI, it’s value above 70 signals overbought and below 30 indicates oversold condition of market momentum.

- ASI: Along with CCI and RSI, ASI also signals the overbought/oversold condition with the same manner of calculations and at the same oscillator window of the chart.

BMANS Renko Trading System: Buy Parameters

- CCI and RSI hold above ASI

- Price breaks above the Dragon Tunnel

- Buy triggers when Nonlang MA turns green

- Stop loss below the Dragon Channels

- Take profit when Nonlang MA turns red and either CCI or ASI crosses below the RSI level at the same time.

Also Check: Double CCI with RSIOMA Trading System

BMANS Renko Trading System: Sell Parameters

- CCI and RSI hold below ASI

- Price breaks below the Dragon Tunnel

- Sell triggers when Nonlang MA turns red

- Stop loss above the Dragon Channels

- Take profit when Nonlang MA turns green and either CCI or ASI crosses above the RSI level at the same time.